inheritance tax proposed changes 2021

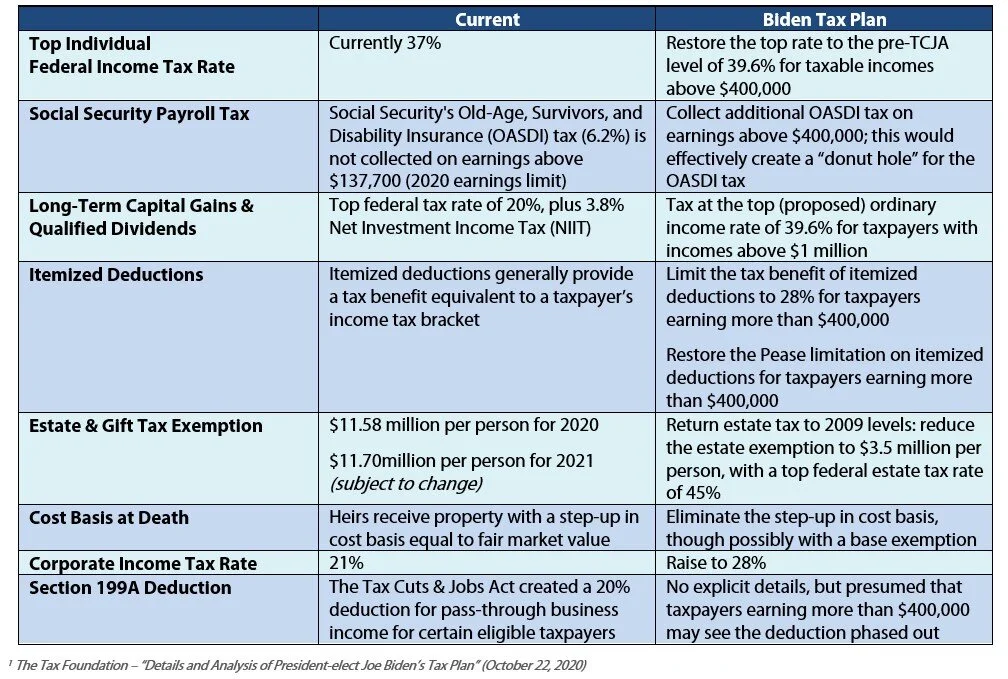

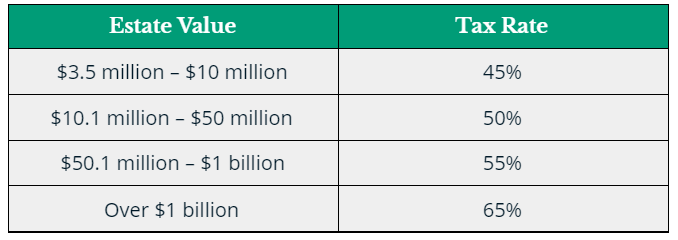

The 2021-2022 State Budget. The proposed impact will effectively increase estate and gift tax liability significantly.

Biden Administration Tax Plan Estate Tax Tax Cuts And Jobs Act And Step Up In Basis Rule Castle Wealth Group

Changes for 2022.

. Andrew Cuomos budget draft. The Biden campaign proposed reducing the estate tax exemption to 35 million per person 7 million for a married couple which is what it was in 2009 while increasing the. The deceaseds spouse is typically exempt meaning.

Through appropriate aid and support the Senate Democratic Majority aims to expand opportunities in New Yorks robust agriculture industry. New York Proposal 1 the New York Redistricting Changes Amendment was on the ballot in New York as a legislatively referred constitutional amendment on November 2 2021. In 2021 Iowa passed a bill to begin phasing out its state inheritance tax eliminating it completely for deaths occurring after January 1 2025.

Jun 16 2021 Proposed inheritance tax changes would be devastating for family farms study shows A newly released Texas AMs Agricultural and Food Policy Center AFPC. A glimpse at legal changes proposed in Gov. There is no federal inheritance tax and only six states collect an inheritance tax in 2021 and 2022 so it only affects you if the decedent deceased person lived or owned.

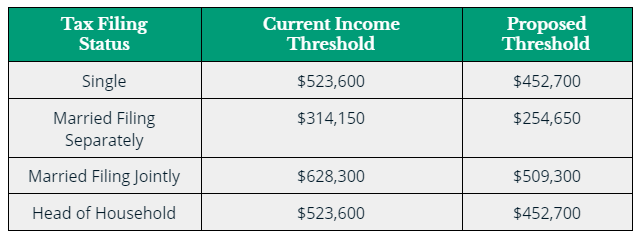

There are signs that the Federal exemption for. The Biden campaign is proposing to reduce the estate tax exemption to. The New York State tax rate schedules in the 2022 instructions for Forms IT-2105 Estimated Tax Payment Voucher for Individuals and IT-2106 Estimated.

The tax rate on the estate of an individual who passes away this year with an estate valued over the 1158 million exemption is also a flat 40. Biden has called for treating inheritances like a sale requiring heirs to pay taxes on death with an exemption for gains under 1 million for single filers and 25 million for married. Unfortunately there are several proposals to get rid of these beneficial tax provisions.

Gifts and generation skipping transfer tax exemption amounts are indexed for inflation increasing to 117 million in 2021 from 1158 million in 2020. Americas small family farms could be destroyed if Congress passes Bidens proposed tax change plan said Grover Norquist President and Founder of Americans. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million.

The budget proposes a temporary surcharge on married taxpayers with a taxable income above 5. The STEP Act announced by Senator Van Hollen proposes to eliminate stepped-up.

Tax Reform Uncertainty Leaves Taxpayers With Questions Fi3 Advisors

Estate Tax Law Changes Could Have Costly Implications Uhy

Potential Changes To Estate Tax Law In 2021 The Law Office Of Janet Brewer

Nelson Mullins House Ways And Means Committee Proposed Tax Changes Impacting High Net Worth And High Income Individuals

2021 Proposed Tax Law Changes Potential Impacts

The New Death Tax In The Biden Tax Proposal Major Tax Change

Proposed Estate Tax Changes Build Back Better Act Phoenix Tucson Az

Does Your State Have An Estate Tax Or Inheritance Tax Tax Foundation

How Estate Tax Changes Could Affect You And Your Family

Proposed Tax Law Changes Where We Are Focused Relative Value Partners

Build Back Better Act And Estate Planning

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Biden Administration May Spell Changes To Estate Tax And Stepped Up Basis Rule Pierrolaw

Proposed Tax Law Changes Where We Are Focused Relative Value Partners

Preparing For Tax Hikes Plan But Dont Panic Bny Mellon Wealth Management

Proposed Changes To Estate Taxes Threaten Farmers And Ranchers Morning Ag Clips

Does Your State Have An Estate Or Inheritance Tax

Estate And Inheritance Taxes Around The World Tax Foundation

What Could The Proposed Tax Changes Mean For Your Estate Plan Our Insights Plante Moran